Malta Hotels and Restaurants Association (MHRA) President Tony Zahra states that challenges for the tourism sector are not yet over however the fact that tourism is a resilient economic sector allows for optimistic forecasts.

Mr Zahra was speaking during the presentation of the MHRA BOV Deloitte Hotel performance survey presentation held earlier today at the Westin Dragonara Resort, Malta.

Mr Zahra added that this is encouraging and can be seen from the outcome of the survey but it is critical not to take such forecasts as guaranteed results.

The survey, commissioned by the MHRA and carried out by Deloitte with the support Bank of Valletta, found that with the gradual relaxation of measures, tourist arrivals in quarter four of 2021 reached 62% of those in the same period in 2019.

Mr Zahra remarked that it is critical that we remain competitive as a destination in the region and therefore it is critical that the remaining Covid restrictions are removed immediately. Mr Zahra also recognized the efforts made by both Government and MHRA members to keep the industry afloat during a very difficult period, and emphasized that such synergy needs to remain to overcome the highly challenging months ahead for a sustainable recovery.

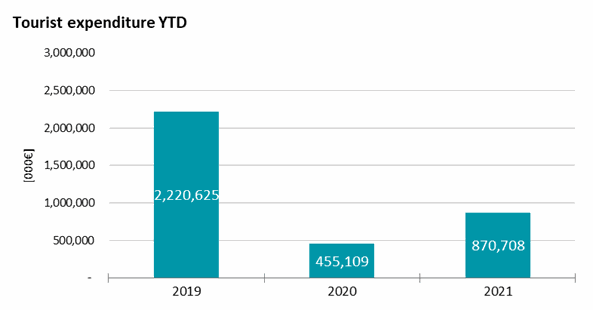

But despite the positive trend in the final quarter of the year, the whole year only reached 35% of 2019 levels.

Although subdued, arrival levels in 2021 still surpassed those of 2020 by 46.9%.

The number of actual guest nights spent by tourists in Q4 of 2021 reached 74% of pre-pandemic levels.

With longer than average lengths of stay registered by tourists in 2021, tourist guest nights reached 43% of those in 2019, compared to the 35% reported of tourist arrivals.

Longer stays compensate for drop in daily spend

Although the average daily spend decreased by 15%, the longer than average length of stay in Q4 resulted in total tourist expenditure for the quarter reaching 65% of 2019 levels, compared to the 62% reported tourist arrivals.

The average daily spend of tourists in 2021 was on par with that of 2019, with total tourist expenditure for the year reaching 39% of 2019 levels when compared to 35% in reported tourist arrivals.

When it comes to occupancy, five-star hotels averaged out at 52% in Q4 2021, when comparatively this was at 69% in 2019, while on a year to date basis, five-star hotels registered an average occupancy of 35%, a decrease of 52.2% from 67% in 2019.

They also saw an average daily room rate of €176 compared to €160 in 2019, making a 10% improvement. The average daily rate for 2021 as a whole was €191, which was set 5.5% higher than 2019.

Overall, five-star hotels registered a gross operating profit that was only slightly below 2019 levels, with €6.169 million for Q4 making up 98% of the gross operating profit registered in the same period in 2019.

Four-star hotels fared slightly better, with an average occupancy rate of 59%, a decrease of 26.2% from the 80% registered during the same period in 2019.

For the whole of 2021, four-star hotels registered an average occupancy of 40%, a decrease of 49.4% when compared to the 81% registered in 2019.

Four-star hotels also reported an increase in the average daily rate for 2021 which went up by 3.9% to €80 per day. In 2021 overall, the average daily rate for four-star hotels was €86 per day, which was 6.5% below 2019 levels. These also registered a gross operating profit of €2.925 million in Q4 2021, when compared to Q4 2019.

MHRA warns operators not to lower their rates

Zahra also warned operators present against lowering their rates to gain volume.

“We are doing well, but we can do better,” he said.

“One way we can keep doing better is to not drop our rates, which we have had a history of doing to gain volume.”

“The data on this is clear, dropping rates will not increase volume but it will lower your income.”

“Every other country is keeping their rates up,” he continued.

“If you want to compete strongly, compete on the services you offer, compete by making sure you have satisfied customers. If you lower your rates you lower your service, which will not lead to happy customers.”

War in Ukraine impacting industry

Speaking at the launch of the survey, Tourism Minister Clayton Bartolo noted that just as the industry was beginning to recover from the pandemic, the war in Ukraine erupted and sent ripple effects that are impacting the industry.

“With war on Europe’s doorstep, we are seeing that the Polish market, one of our strongest, has also been affected.”

Bartolo said his ministry was committed to develop this market further and plans are in the works for the Malta Tourism Authority to open an office in Poland to strengthen the country’s effort to diversify markets.

Bartolo added that in spite of this, the outlook for the industry is optimistic, with four-star hotels seeing 90% capacity and five-star hotels looking to surpass the 80% capacity mark over the Easter weekend.

Last year the Ministry of Tourism, MTA in collaboration with MHRA and other stakeholders launched the STAR JOURNEY initiative with the aim to set Malta and Gozo as an In-Partnership with Forbes Travel Guide Destination – a project which spearheads various initiatives focusing on service excellence and safety.

In this context, Minister Bartolo announced that over 50% of the hotels across Malta and Gozo have over the past 5 months been recognised as Sharecare Verified by Forbes Travel Guide properties. This means that now destination Malta will be recognized by Forbes Travel Guide as being fully committed to the health and safety of guests and employees and accordingly will allow the Malta Tourism Authority to use the digital Health Security VERIFIED logo – a first in the world.

This is in line with the objective, that of further removing the Covid 19 related restrictions, whilst continuing to ensure safety for both our guests and employees through industry self regulation management practices as independently recognised by world renowned brand Forbes Travel Guide.